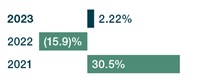

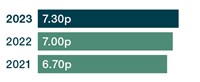

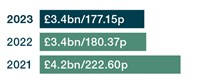

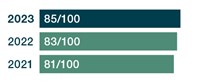

Our objective is to deliver attractive and risk appropriate returns to Shareholders, by executing the Group’s investment policy and operational strategy.

Set out below are the key performance indicators we use to track our progress. For a more detailed explanation of performance, please see our Annual Report.